As ESG (Environmental, Social, and Governance) performance becomes a core measure of corporate responsibility and business resilience, the way we manage and report on ESG must evolve. Traditional approaches—relying on spreadsheets, disjointed documentation, and manual review—simply can’t keep up with today’s expectations for speed, accuracy, and accountability.

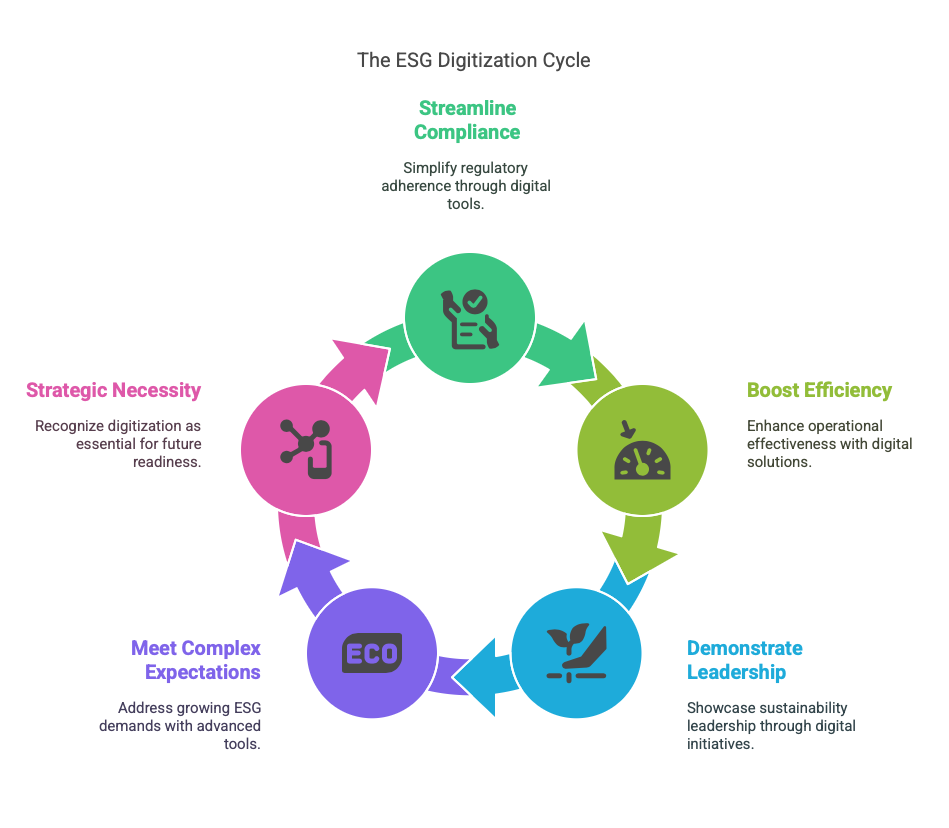

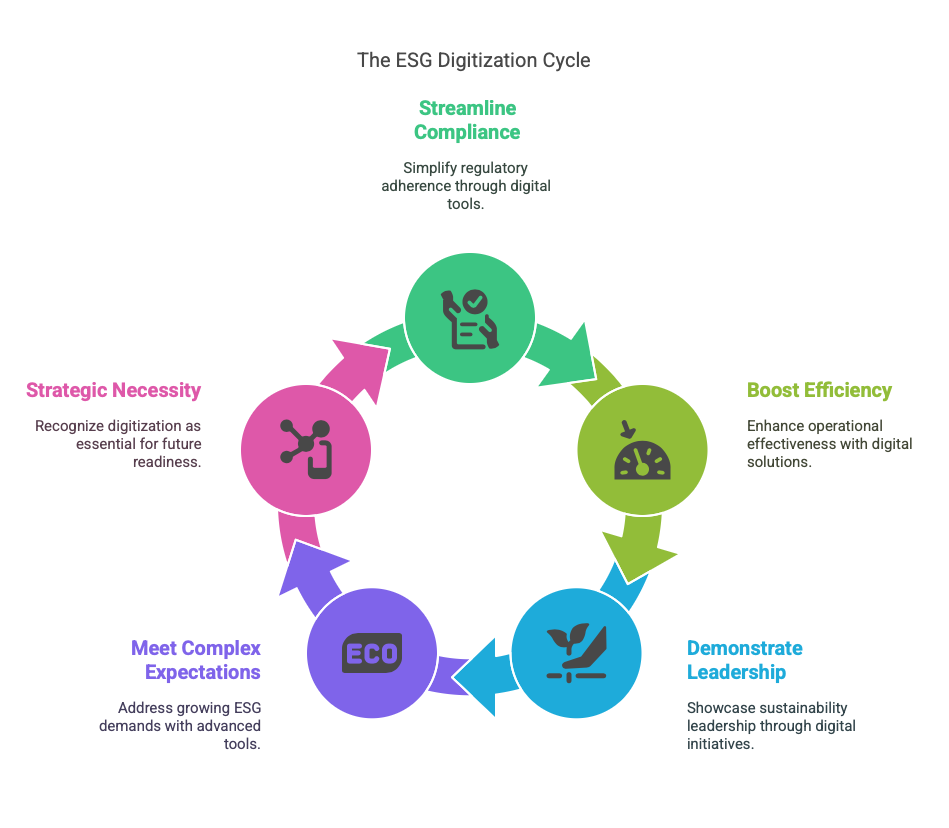

Digitization is no longer a future goal; it’s a present-day imperative for organizations that want to lead with transparency, act with precision, and ensure long-term value. Here’s why moving to a digital ESG system is not just smart, but essential:

1. One Source of Truth: Centralized and Consistent Data

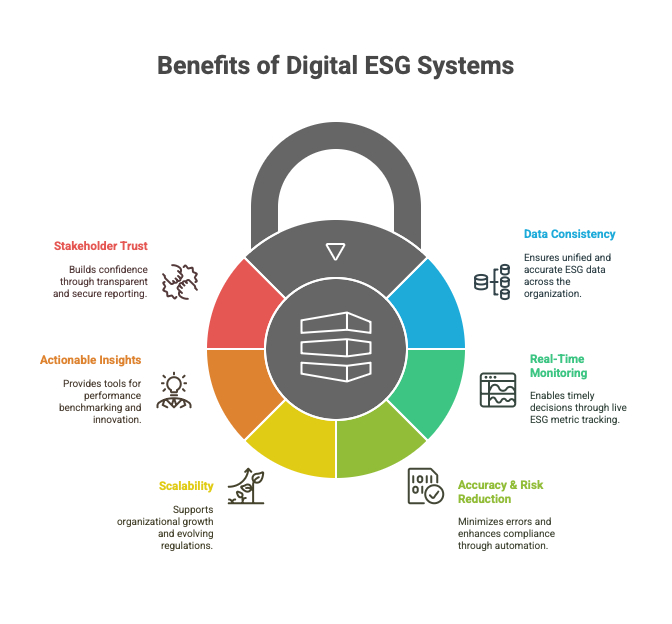

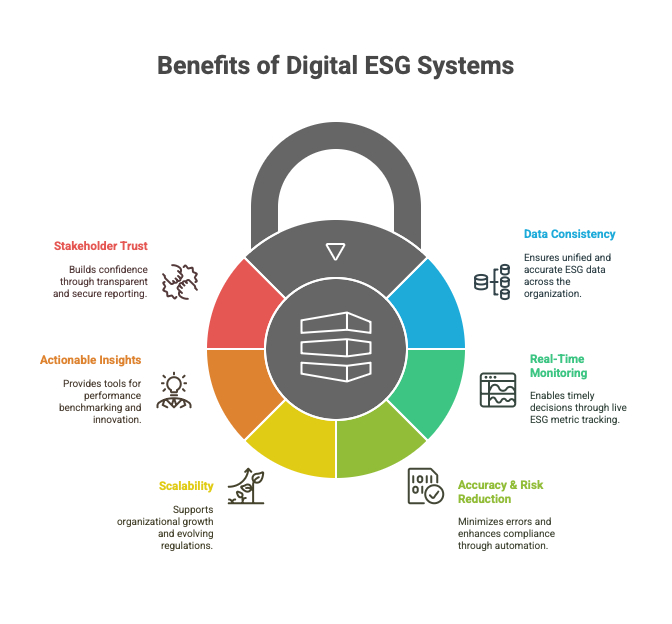

Digitizing ESG management brings all sustainability-related data into a single, unified platform. This centralization helps eliminate duplicate entries, reduce manual errors, and promote consistency across departments and supply chains. It ensures that decision-makers and stakeholders are working from the same reliable data set.

2. Real-Time Monitoring Means Better Decisions

Real-time dashboards and automated reporting tools enable quick visibility into ESG metrics and trends. Instead of waiting weeks or months for static reports, organizations can course-correct faster, ensure ongoing compliance, and report meaningfully against standards like GRI, CSRD, or TCFD.

3. Accuracy You Can Rely On

Manual ESG assessments leave too much room for error. With digital tools, data validation, pre-set templates, and automated calculations raise the standard of accuracy. This not only supports stronger audit performance but also helps mitigate compliance risks and reputational harm.

4. Scalable, Flexible, and Ready for the Future

Whether your company is expanding globally or adapting to new reporting standards, digital ESG systems are designed to scale. They offer flexibility that spreadsheets and ad hoc reports can’t match—keeping you ready for what’s next, not just what’s now.

5. From Reporting to Strategy: Actionable Insights

Digitized ESG platforms don’t stop at compliance. They provide benchmarking tools, root cause analysis, and even predictive analytics to help you make smarter, more strategic decisions. ESG becomes not just a reporting obligation, but a driver of innovation and continuous improvement.

6. Trust Through Transparency

With clear audit trails, secure digital records, and streamlined disclosure tools, stakeholders can trust the ESG data being reported. This transparency boosts investor confidence, strengthens brand value, and reinforces your company’s reputation as a responsible and forward-thinking organization.

Conclusion: ESG Digitization Isn’t Optional—It’s Essential

Organizations that digitize their ESG processes set themselves apart—improving internal efficiency, staying ahead of compliance risks, and demonstrating leadership in sustainability. In a world where ESG expectations are only growing, leaving manual systems behind is not just a good idea—it’s essential.