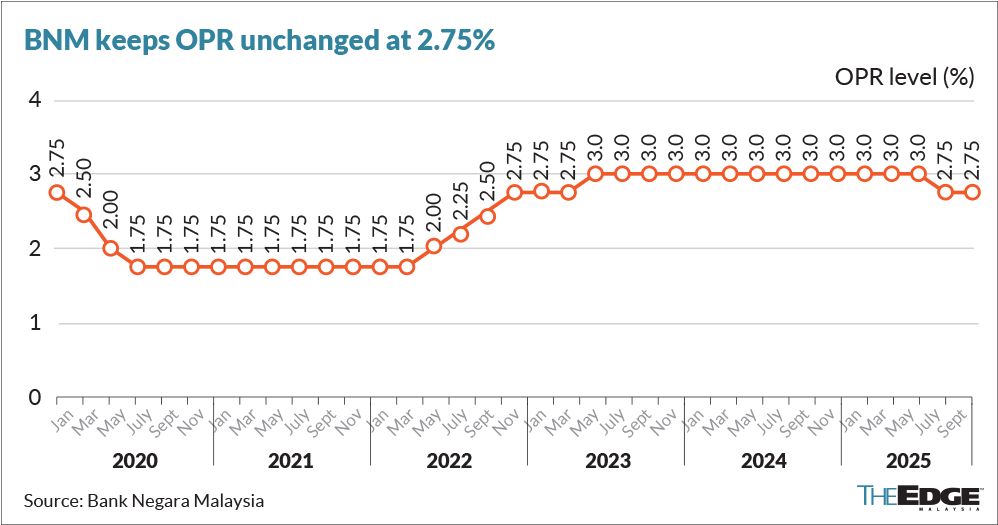

Bank Negara Malaysia (BNM) has decided to maintain the Overnight Policy Rate (OPR) at 2.75% following its final Monetary Policy Committee (MPC) meeting for 2025, held on November 6. The rate has remained unchanged since July 2025, when it was reduced from 3.00% to 2.75%. The next MPC meetings in 2026 are scheduled for January 22, March 5, May 7, July 9, September 3, and November 5.

With the OPR staying at 2.75%, borrowing costs remain low, meaning car loans and other financing options are likely to remain affordable and easier to obtain. This continues to support consumers and businesses by reducing the cost of borrowing.

For the Malaysian economy, growth in the third quarter of 2025 was better than expected, driven by strong domestic demand, resilient electrical and electronics (E&E) exports, and a recovery in commodity production. Looking ahead, economic growth in 2026 is expected to be supported by the progress of multi-year projects in both the private and public sectors, the realisation of approved investments, measures under Budget 2026, and a rebound in tourism activity.

In terms of inflation, headline inflation averaged 1.4% and core inflation 1.9% in 2025. Moving into 2026, inflation is expected to remain moderate, supported by easing global cost pressures, stable commodity prices, and the absence of excessive demand pressures.

BNM said that the current OPR level is appropriate and supportive of economic growth amid price stability. The central bank will continue to monitor economic developments and assess risks related to domestic growth and inflation.

BR 16824

BR 16824  VN 12675

VN 12675  US 10691

US 10691  AR 3879

AR 3879  MY 3614

MY 3614  GB 2762

GB 2762  MX 2656

MX 2656  CN 1926

CN 1926