- What is the minimum tax penalty under the revised tax audit framework?19-May-2022

- How to apply International Integrated logistics service (IILS) from MIDA19-May-2022

- DuitNow Tax REfund18-May-2022

- audit confirmation request12-May-2022

- Double deduction for scholarships provided by companies12-May-2022

- BKM 2022 is open for appeal10-May-2022

- How can I buy company information from SSM?10-May-2022

- ���Ϊʲô��ְ?06-May-2022

- Shareholders' rights Malaysia04-May-2022

- Who is the Employee?29-Apr-2022

- New Minimum Wages Order effective 1 May 202228-Apr-2022

- Special Tax Deduction Rental Reduction26-Apr-2022

- Is director��s medical expense tax-deductible in Malaysia?26-Apr-2022

- Applicability Of Section 140 Of The ITA 1967 on Transfer Pricing Adjustment25-Apr-2022

- How to amend tax return after filing under S 131 of the Income Tax Act 196721-Apr-2022

- (Latest update) Withholding Tax on Payments to Agents21-Apr-2022

- û���ʸ�����˰2%�IJ���20-Apr-2022

- ��˰2%�IJ���18-Apr-2022

- How do you audit the opening balance for initial engagement?14-Apr-2022

- Tax Responsibility of Employer13-Apr-2022

- What is the tax treatment for the income received by medical practitioners (Specialist Doctors)?13-Apr-2022

- How are joint ventures accounted for?11-Apr-2022

- Tax clearance Malaysia LHDN11-Apr-2022

- New e-Telegraphic Transfer (e-TT) System for Tax Payments07-Apr-2022

- How BAD is a Qualified Audit Report?07-Apr-2022

- Difference Between GAAP vs IFRS06-Apr-2022

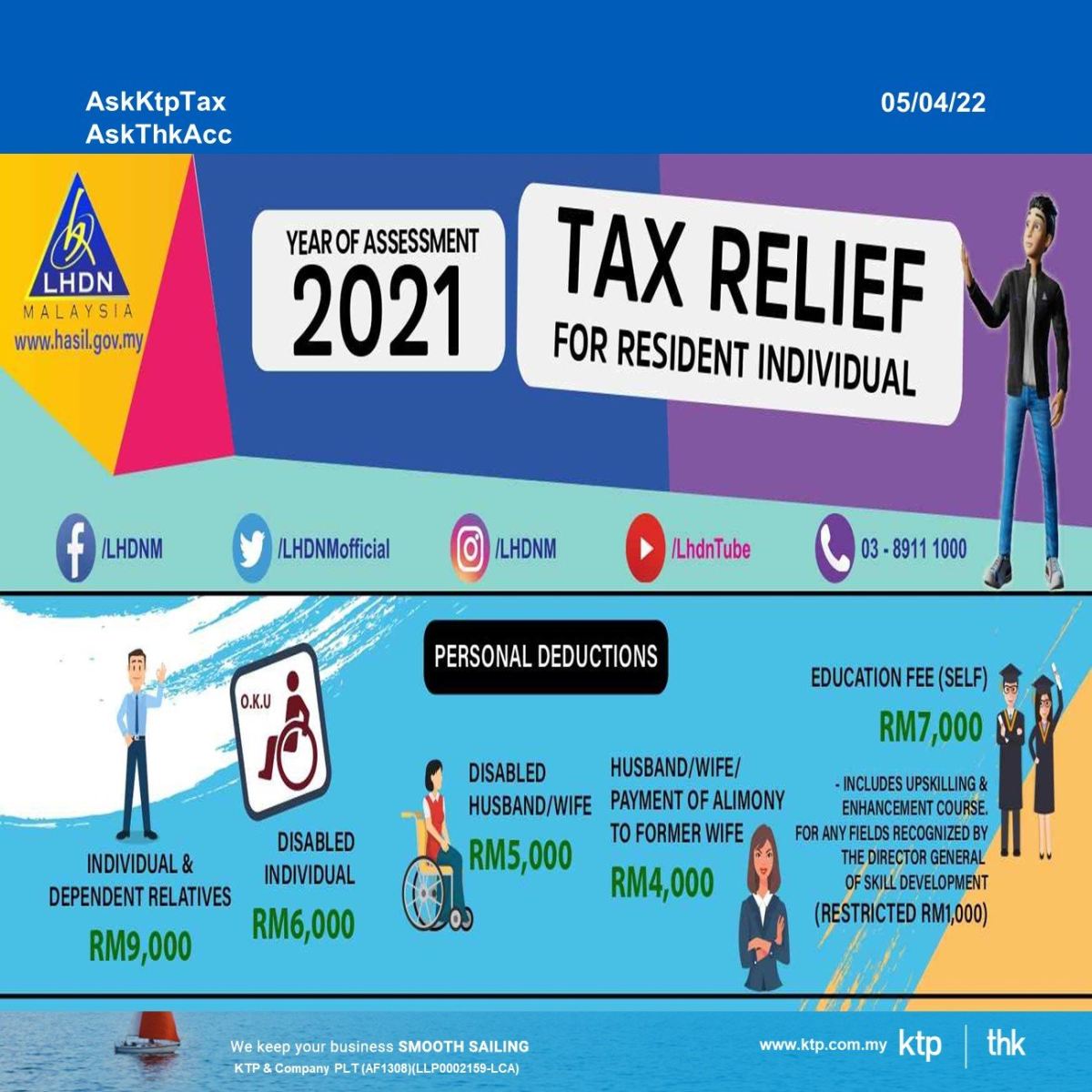

- Personal Income Tax Relief 2021 Malaysia05-Apr-2022

- Bad debts written off LHDN04-Apr-2022

- Why do auditors audit related party transactions?01-Apr-2022

- How does audit work in Malaysia?30-Mar-2022

- THK Management Advisory Sdn Bhd

- Home

- Products (6)

- News

- Photos

- Map

- Contact

- Web Statistic

- VISITORS:

Please login to use this feature.

You can use this feature to add the product to your favourite list.

Close

You have added this product to your favorite list.

Check My Favourite

Close

You have removed this product from your favourite list.

Close

Please login to use this feature.

You can use this feature to add the company to your favourites list.

Close

This company has been added successfully.

Check My Favourite

Close

This company has been removed from your favourite list.

Close

Please login to use this feature.

You can use this feature to add the company to your inquiry cart.

Close

This company has been added to your inquiry cart.

Close

This company has been removed from your inquiry cart.

Close

This product has been added to your inquiry cart.

Close

This product has been removed from your inquiry cart.

Close

Maximum number of Product/Company has been reached in inquiry cart.

Close

Daily Login Reward

Congratulations!

You��ve earned your daily login reward for today!

5 NP PointHere are the reward you��ve earned!

Check your Daily Login Rewards

Be sure to come back everyday for more rewards!

Thanks!

Main Office

THK Management Advisory Sdn Bhd 200401000220 (638723-X)

Wisma THK, No. 41, 41-01, 41-02, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru, Johor, Malaysia.

Tel:

Email:

Website: https://www.thks.com.my

Website: https://thks.newpages.com.my/

Website: https://thks.n.my/

Browse by : Home - Classifieds - Companies - Location - Tags - Products - News & Promotion - Job Vacancy - Mobile Website - Google - SEO Results