Without doubt, AI driven systems have made a significant portion of financial reporting, auditing and various analyses much easier and more efficient, but at the same time it has made the Forensic Accountants’ data handling aspects too complex.

Before accepting data from the system, one needs to confirm and segregate trade transactions generated or summarized by AI systems and then one needs to verify the authenticity and integrity of algorithmic outputs.

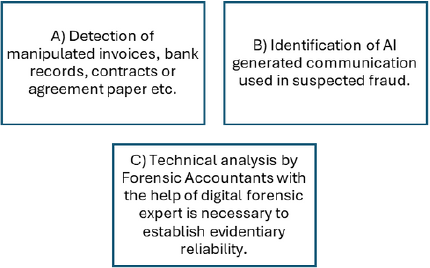

AI tool can create fake documents, emails and video including voice recording which appears hyper realistic creating unprecedented challenges during verification process such as:

It is important to note that AI is not only a target but can be used as a tool by fraudsters. AI generally operates with minimum human interference therefore it limits visibility with the source of data inputs and sequence of transformation applied by algorithms. This creates difficulty in establishing a clear audit trail essential for forensic investigation.

This is further complicated in the absence of AI specific legal frameworks because during expert witness testimony, the Forensic Accountants may face unprecedented challenges to confirm and show the process through which AI has derived a result and been accepted.

Generally, the Forensic Accountants are trained in traditional auditing and investigative methods whereas the constant rise in the use of AI tools by our society in various business recordings and authentication, it is essential to have the knowledge of data science, algorithms, and AI ethics. Hence upskilling of Forensic Accountants has become increasingly essential to keep pace with rapid technology.

Forensic Accountants must evolve from traditional role or examining records to digital intelligence professional. We need to blend accounting expertise with data analysis, cyber security awareness and AI literacy where the key is to realize algorithmic opacity. This is because we can see that what has gone and what has come out but we cannot understand how & why the system has reached out that result.

For example, in a large corporation’s centralized accounting system AI model flagged few suspicious transactions for investigation but the Forensic Accountant can’t explain why specific transactions were flagged. Hence once flagged the Forensic Accountant will have to further investigate to confirm the reasons unless he/she uses certain tools now available to clear the opacity of algorithm.

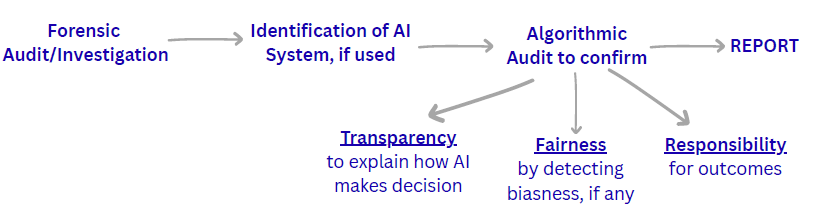

There are certain modern solutions such as Explainable AI (XAI) tool that can provide reasons for AI output in a readable form for a human. Another tool is through “Algorithmic audit” which examines an AI or automated decision-making system to understand how it works, verify its fairness and check whether it complies with various parameters such as relevant laws, ethical standards or business objectives for a given result which the AI has produced.

As a result of audit reviews, the data that framed the algorithm, logic or model design and the outcome AI has produced. This is essential to ensure and reflect that the AI has behaved in an accurate, unbiased and explainable manner during testimony.

Why it is important for Forensic Accountants?

Only through these tools one can verify that the algorithm has not been manipulated to conceal certain bias while producing the outcome. It is also essential to explain why an automated system has flagged certain transactions out of pool of transactions.

This will also help to provide evidence in legal cases showing AI driven decisions are fair & explainable.

CASE STUDY

Fraud detection system in a Bank

AI model was being used at a large bank to flag suspicious transactions. Over a period of time, it was noticed that some fraudulent transfers are not being detected but legitimate are often flagged.

Algorithmic audit confirmed that the model was framed based on outdated transaction patterns and certain high value transactions were excluded from the tracing data due to privacy filter, which resulted in false negative. Further, software update was done without proper documentation and did not correct weighting to essential parameters.

Conclusion

As a result of this new challenge created by the development of AI, the Forensic Accountants will be required to evolve into algorithmic investigators who are capable both in accounting analysis and understanding machine logic.

It may appear simple, but in the opinion of the author, it needs high level of upskilling or help of an expert of AI & Algorithmic audit which may turn out to be a new field of audit profession.

*************************

Author,

Prabhat Kumar, Chief Investigating Officer